While the price increases for the raw materials that we need in our precision machining shops continue to climb (March ISM Data), the policy makers tell us it is not inflationary.

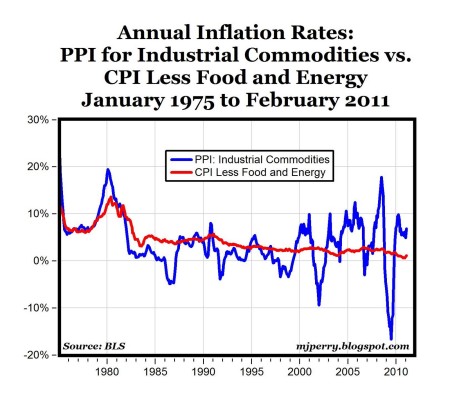

Here’s the graph and an explanation from Mark J Perry, economist at the University of Michigan that tells them to tell us not to panic.

Unfortunately, it doesn’t tell us how to deal with the squeeze between our large OEM suppliers ‘This is the price- pay it !” and our large OEM customers-”We aren’t accepting any price increase. We’re not paying.”

I have found Mark Perry to be a pretty clear thinker, so here is his post:

RISING COMMODITY PRICES DO NOT NECESSARILY LEAD TO HIGHER CORE CPI INFLATION

by Mark J. Perry

Not much APPARENT effect...

We hear a lot of talk about how rising prices for copper, cotton, oil, and other commodities are signaling that inflationary pressures are building up in the general U.S. economy, implying a direct and tight connection between commodity prices and consumer prices. For example, Atlanta Fed President Dennis Lockhart said recently that rising commodity prices are creating “

inflation anxiety.” But what exactly are the implications of rising commodity prices for core inflation, and how closely are those two variables related?

That’s the question posed in a new

Chicago Federal Reserve Bank research paper by Charles Evans and Jonas Fisher. As the chart above of annual PPI inflation rates for industrial commodities and the annual core CPI inflation rates shows, the answer to the question is “not very much.” From the introduction of the paper:

“The recent run-ups in oil and other commodity prices and their implications for inflation and monetary policy have grabbed the attention of many commentators in the media. Clearly, higher prices of food and energy end up in the broadest measures of consumer price inflation, such as the Consumer Price Index. Since the mid-1980s, however,

sharp increases and decreases in commodity prices have had little, if any, impact on core inflation, the measure that excludes food and energy prices.

Some economists argue that rising commodity prices are inflationary and, therefore, require a tightening of monetary policy. Others say rising commodity prices have sometimes led to inflation and sometimes not. Therefore, a monetary policy response may not be required. In this Chicago Fed Letter, we empirically assess these views by conducting a statistical analysis of quarterly data on commodity prices, inflation, and monetary policy since 1959. We find that since the mid-1980s, after the big oil shocks and the tenure of Paul Volcker as chairman of the Federal Open Market Committee (FOMC), the

reactions of both core inflation and the federal funds rate (the monetary policy instrument) to shocks in oil and other commodity prices have been extremely modest.”

SOP: We’ll come back another time to discuss whether or not Core CPI is an honest measure of inflation or another one of those indicators hijacked by the functionaries inside the city.

In the meantime,the cost of the commodities we buy, and their surcharges and transportation, continue to rise.

You can follow Mark J Perry on his

Carpe Diem Blog

Source: PMPA

CNC Turning

CNC Turning